This article from FTI Consulting presents fundamental steps to safeguard your organization against fraud.

Advances in technology, including AI, have led organizations to implement increasingly sophisticated fraud prevention and detection strategies. International Fraud Awareness Week (17-23 November 2024) serves as a timely reminder for businesses not to overlook the basics of fraud prevention. A fundamental step in safeguarding against fraud is conducting thorough background checks – especially for those in positions of trust – and paying close attention to any red flags raised in the process.

Who Commits Fraud?

The Association of Certified Fraud Examiners (‘ACFE’) finds that individuals who commit fraud typically share certain traits.

They often hold positions of trust, which provide them with access to the organization’s assets.

Two-thirds of fraud cases are perpetrated by managers or executives who have sufficient experience to know how to circumvent controls and cover their tracks.

Men perpetrate fraud in 74% of cases.

Other factors, such as having a higher level of education, or having a longer tenure with a company, coupled with delays in fraud detection, tend to result in higher median fraud losses.

Understanding the profile of a fraudster allows organizations to conduct enhanced background checks for individuals with these high-risk attributes.

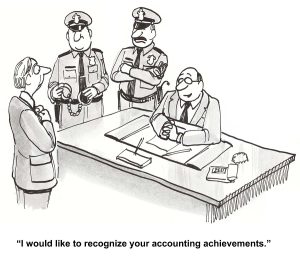

A Fraudulent Application Leads to Fraud

A recent example of how a thorough background check could have prevented fraud occurred in South Australia in 2019. Veronica Theriault was appointed as Chief Information Officer within the Department of Premier and Cabinet (DPC’), securing a lucrative role with an annual salary of AUD $270,000. Her position was obtained through deception. She fabricated her CV, falsifying educational and employment history, provided fraudulent references – including impersonating a former colleague, and used a photo of supermodel Kate Upton on her LinkedIn profile. During her month in the role, Theriault earned approximately AUD $33,000 and arranged for her brother to be awarded a contract role, despite his lack of qualifications, for which he received AUD $21,000 These actions, along with the falsification of her CV, were uncovered shortly after, leading to her arrest and subsequent conviction for deception and other offences.

Don’t Just Do a Background Check, Pay Attention to the Results!

According to ACFE’s 2024 Report to the Nations, 84% of fraudsters did not have a documented fraud-related criminal or employment history check. This highlights the importance of not only conducting a criminal history check, but also verifying professional qualifications, work history, and references. The New South Wales Independent Commission Against Corruption found that 20% to 30% of job applications contain verifiable false information.7

Companies need to pay attention to red flags that appear as part of the background check process. The ACFE found that in 16% of cases where a background check had been conducted on a perpetrator of fraud, some prior activity was revealed as part of the check that should have been a warning sign, but the organization hired them anyway.8

Take a Risk-Based Approach To Reduce Fraud Exposure

FTI Consulting recommends reviewing your organization’s approach to conducting background checks, taking a risk-based approach to ensure senior executives and those in high-risk roles such as finance, system administrators, accounts payable, and procurement are subject to the most robust screening processes. At FTI Consulting, when conducting background checks for clients on high-risk hires, we independently verify qualifications, conduct criminal history checks, review public record sources such as bankruptcy, litigation, online and media sources, and in some cases, identify and speak to individuals who have previously worked with the candidate.

In conclusion, organizations should commit to not just performing background checks, but also acting on the results—especially when red flags emerge. By doing so, you can significantly reduce exposure to fraud and safeguard both your organization’s assets and reputation.

James P. Randisi, President of Randisi & Associates, Inc., has been helping employers protect their clients, workforce and reputation through implementation of employment screening and drug testing programs since 1999. This post does not constitute legal advice. Randisi & Associates, Inc. is not a law firm. Always contact competent employment legal counsel. To learn more about the rights of employees who test positive for marijuana, Mr. Randisi can be contacted by phone at 410.494.0232 or Email: info@randisiandassociates.com or the website at Randisiandassociates.com